Over the last year it’s been hit with constant selling pressure and bad press saying this investment is down and out for the count.

I couldn’t disagree more.

What will take the Dow to 100K? Easy.

America 2.0.

The innovative and disruptive technologies of tomorrow.

Electric vehicles, precision medicine, 3D printing, vertical farming, cryptocurrencies…

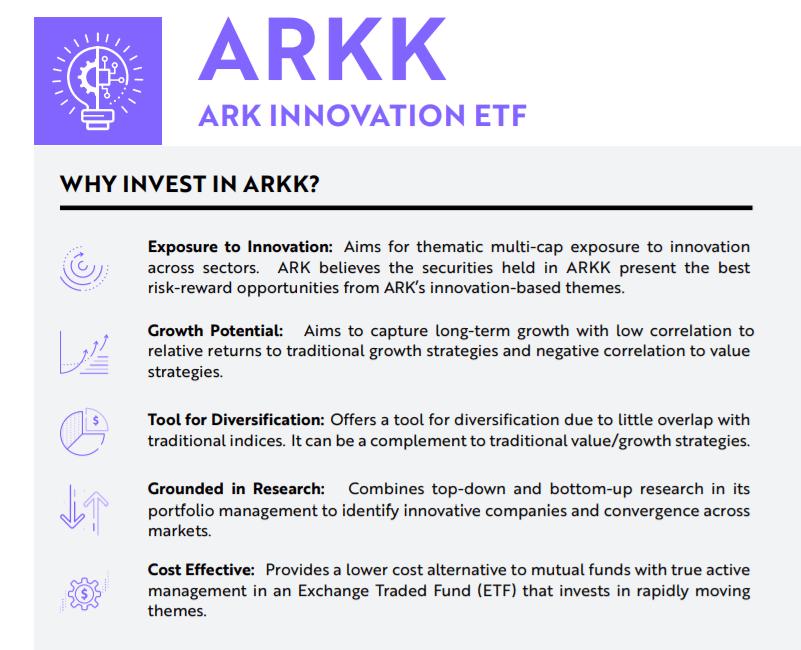

Take Cathie Wood’s ARK Innovation ETF (NYSE: ARKK).

Much like what would help the Dow make the six-figure surge, ARKK is filled with America 2.0 plays that are ripe to reap huge returns.

ARKK’s all-time high was last year at $159.70.

However now it is down 66% to $52:

This was driven by many factors: profit taking, rising interest rate narrative, fear from war and geopolitical crisis.

There’s no doubt these things need to be taken seriously, but the constant bombardment from the media on these issues drive people away from investing in the future.

None of these factors have damaged the long-term trajectory of these stocks. The companies still have fundamental growth and are stealing market share from traditional America 1.0 business models.

The technology is still young — maybe a few decades old, but it’s just getting adopted in today’s world.

The reason being is the cost has declined, while also providing a superior product and service for the user.

Tesla is a good example.

In Cathie Wood’s research she talks about Wright’s Law, which basically plots out the cost decline of new technology over time.

About a decade and a half ago the price of a lithium-ion battery was $300 per kilowatt-hour, when electric vehicles were not rolling off production lines.

Yet last year the price has dropped 70% to less than $100 per kilowatt-hour.

This coincides with gas prices leaping higher to $6 per gallon in some parts of the U.S., like California.

I know I’m tired of paying close to $100 every trip to the pump.

Sky-high gas prices are just great advertisements for EVs (electric vehicles).

We’re seeing dramatic cost reductions across all mega trends in America 2.0:

As time goes on the price and technology will only get better, which in turn will lead to more adoption.

This is why I think over the next three to five years Cathie Wood’s ARKK ETF could reach $200 or generate a 280% return.

At Bold Profits Daily we have the same long-term vision as Cathie Wood.

We understand adoption and change take time…

And you can see that when you invest in America 2.0 opportunities using our services or by buying the ARK Innovation ETF.

Either way, you experience the ups and downs.

In 2020, ARKK saw a 152% return, but as I stated above, ARKK has fallen 66% from its high.

But just as Wright’s Law shows, technology is getting less expensive.

That means more growth, more adoption and the decline of America 1.0.

As America 2.0 innovators — like Tesla and others from ARKK — continue to disrupt, eventually they’ll have to be put into the Dow Jones because they make up the real modern economy.

And THEN, Dow 100K, here we come!

If you want our full Dow 100K prediction, here’s the official transcript from Paul’s interview. You’ll also see how to unlock our America 2.0 portfolio picks.

Click here to see the details.

Happy investing,

Patrick Goodrich

Analyst, Bold Profits Publishing

P.S. High gas prices stink. But they are a huge advertisement for electric vehicles (EVs). And that’s great news for investors. You see, Tesla’s “employee No. 7” found the secret to a super battery. We’re talking 12-million-mile kind of super… Click here for the full story now.